Mumbai, November 07, 2024: Pharma major Lupin Limited [BSE: 500257 | NSE: LUPIN] reported its financial performance for the quarter ending September 30, 2024. The unaudited results were taken on record by the Board of Directors at a meeting held today.

Financial Highlights – Consolidated IND-AS

Amt in INR Mn

| Particulars | Quarter | ||||

| Q2 FY25 |

Q2 FY24 |

YoY Growth % | Q1 FY25 |

QoQ Growth % |

|

| Sales | 54,970 | 49,392 | ↑11.3% | 55,143 | ↓-0.3% |

| EBITDA | 13,827 | 9,582 | ↑44.3% | 13,088 | ↑5.6% |

| EBITDA Margin (%) | 25.2% | 19.4% | ↑580bps | 23.7% | ↑150bps |

| PBT | 10,549 | 6,297 | ↑67.5% | 9,930 | ↑6.2% |

| PAT | 8,595 | 4,953 | ↑73.5% | 8,055 | ↑6.7% |

Income Statement Highlights – Q2 FY2025

- Gross Profit was INR 38,071 Mn compared to INR 32,365 Mn in Q2 FY2024, with gross margin of 69.3%.

- Employee Benefits cost was 18.3% of sales at INR 10,075 Mn compared to INR 8,607 Mn in Q2 FY2024.

- Manufacturing and other expenses were at 30.3% of sales at INR 16,670 Mn compared to INR 15,520 Mn in Q2 FY2024.

- PBT was 19.2% at INR 10,549 Mn on account of better performance of Q2 FY2025 rising from PBT of INR 6,297 Mn in Q2 FY2024 by over 67.5%.

- Investment in R&D for the quarter was INR 4,481 Mn (8.2% of sales).

Balance Sheet Highlights as on date September 30, 2024

- Operating working capital was INR 65,617 Mn.

- Capital Expenditure for the quarter was INR 1,449 Mn.

- Net Debt as on September 30, 2024, stands at INR 2,742 Mn.

- Net Debt-Equity as on September 30,2024 stands at 0.02.

Mr. Nilesh Gupta, Managing Director, Lupin Limited said “The second quarter of FY25 reflects continued strength in our business across regions. With 40% of our U.S. revenues now coming from complex generics, India back to double-digit growth and our pipeline delivering consistently, we aim to continue improving our performance aided by sustained operating efficiencies and investment in technology”.

Consolidated Financial Results Q2 FY2025

Amt in INR Mn

| Particulars | Q2 FY25 | % to sales | Q2 FY24 | % of sales | YoY Gr% | Q1 FY25 | % to sales | QoQ Gr% |

| Sales | 54,970 | 100.0% | 49,392 | 100.0% | 11.3% | 55,143 | 100.0% | -0.3% |

| Other operating income | 1,757 | 3.2% | 994 | 2.0% | 76.8% | 860 | 1.6% | 104.3% |

| Total Revenue from operations | 56,727 | 103.2% | 50,386 | 102.0% | 12.6% | 56,003 | 101.6% | 1.3% |

| Material cost | 16,899 | 30.7% | 17,027 | 34.5% | -0.8% | 17,446 | 31.6% | -3.1% |

| Gross Profit (Excl. Other op Inc.) | 38,071 | 69.3% | 32,365 | 65.5% | 17.6% | 37,697 | 68.4% | 1.0% |

| Employee cost | 10,075 | 18.3% | 8,607 | 17.4% | 17.0% | 9,710 | 17.6% | 3.8% |

| Mfg. & Other expenses | 16,670 | 30.3% | 15,520 | 31.4% | 7.4% | 15,985 | 29.0% | 4.3% |

| Other Income | 423 | 0.8% | 404 | 0.8% | 4.7% | 678 | 1.2% | -37.6% |

| Forex Loss / (Gain) | (321) | -0.6% | 54 | 0.1% | -690.1% | 454 | 0.8% | -170.6% |

| EBITDA | 13,827 | 25.2% | 9,582 | 19.4% | 44.3% | 13,088 | 23.7% | 5.7% |

| Depreciation, Amortization & Impairment Expenses | 2,569 | 4.7% | 2,479 | 5.0% | 3.6% | 2,478 | 4.5% | 3.7% |

| EBIT | 11,257 | 20.5% | 7,103 | 14.4% | 58.5% | 10,610 | 19.2% | 6.1% |

| Finance cost | 709 | 1.3% | 806 | 1.6% | -12.1% | 680 | 1.2% | 4.2% |

| Profit Before Tax (PBT) | 10,550 | 19.2% | 6,297 | 12.7% | 67.5% | 9,930 | 18.0% | 6.2% |

| Tax | 1,954 | 3.6% | 1,344 | 2.7% | 45.4% | 1,875 | 3.4% | 4.2% |

| Profit After Tax (PAT) | 8,595 | 15.6% | 4,953 | 10.0% | 73.5% | 8,055 | 14.6% | 6.7% |

| (+) Share of Profit from JV | – | 0.0% | – | 0.0% | NA | – | 0.0% | NA |

| (-) Non-Controlling Interest | 69 | 0.1% | 56 | 0.1% | 21.1% | 42 | 0.1% | 64.3% |

| Profit for the period | 8,526 | 15.5% | 4,897 | 9.9% | 74.2% | 8,013 | 14.5% | 6.4% |

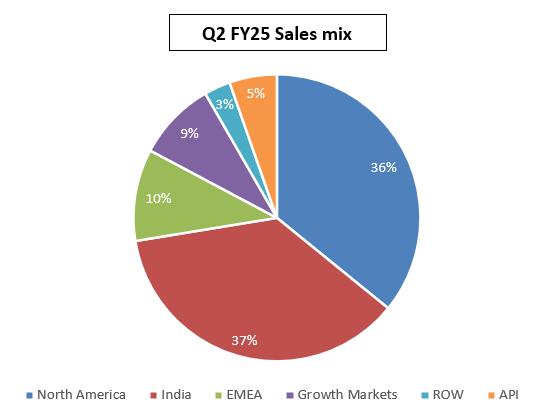

Sales Mix

Amt in INR Mn

| Particulars | Q2 FY25 | Q2 FY24 | YoY Growth% | Q1 FY25 | QoQ Growth% |

| North America | 19,711 | 18,666 | 5.6% | 20,408 | -3.4% |

| India | 20,096 | 16,915 | 18.8% | 19,259 | 4.3% |

| EMEA | 5,693 | 4,759 | 19.6% | 5,031 | 13.2% |

| Growth Markets | 4,896 | 4,378 | 11.8% | 5,151 | -5.0% |

| ROW | 1,629 | 1,990 | -18.1% | 1,672 | -2.6% |

| Total Formulations | 52,026 | 46,708 | 11.4% | 51,521 | 1.0% |

| API | 2,944 | 2,684 | 9.7% | 3,622 | -18.7% |

| Total Product Sales | 54,970 | 49,392 | 11.3% | 55,143 | -0.3% |

Operational Highlights

North America

North America Q2 FY2025 sales were INR 19,711 Mn, up 5.6% compared to INR 18,666 Mn in Q2 FY2024; accounting for 36% of Lupin’s global sales.

U.S. Q2 FY2025 sales were USD 220 Mn compared to USD 213 Mn in Q2 FY2024. The Company received 10 ANDA approvals from the U.S. FDA and launched 2 products in the quarter in the U.S. The Company now has 162 generics products in the U.S.

Lupin continues to maintain its leadership position as the 3rd largest pharmaceutical player in both U.S. generics market and U.S. total market by prescriptions (IQVIA Qtr. Sept’24 NSP data). Lupin is the leader in 51 of its marketed generics in the U.S. and amongst the Top 3 in 107 of its marketed products (IQVIA Qtr. Sept’ 24).

India

India formulation sales for Q2 FY2025 sales were INR 20,096 Mn, up 18.8 % compared to INR 16,915 Mn in Q2 FY2024; accounting for 37% of Lupin’s global sales.

India Region Formulation sales grew by 10.9 % in the quarter, as compared to Q2 FY2024. The Company launched 5 brands across Diabetes, Neuro/CNS, GI, Cardiac, and Gynae therapies during the H1 period. Lupin is the 7th largest company in the Indian Pharmaceutical Market (IQVIA MAT Sept’ 24).

Growth Markets (APAC and LATAM)

Growth Markets sales for Q2 FY2025 were INR 4,896 Mn up 11.8 % compared to INR 4,378 Mn in Q2 FY2024; accounting for 9% of Lupin’s global sales.

Europe, Middle East and Africa (EMEA)

EMEA sales for Q2 FY2025 were INR 5,693 Mn, up 19.6% compared to INR 4,759 Mn in Q2 FY2024; accounting for 10 % of Lupin’s global sales.

Global API

Global API sales for Q2 FY2025 were INR 2,944 Mn, up 9.7 % compared to INR 2,684 Mn in Q2 FY2024; accounting for 5% of Lupin’s global sales.

Research and Development

Investment in R&D was INR 4,481 Mn (8.2% of sales) for the quarter compared to INR 3,764 Mn (7.6% of sales) for Q2 FY2024.

Lupin received approval for 10 ANDA from the U.S. FDA in the quarter. Cumulative ANDA filings with the U.S. FDA stand at 431 as of September 30, 2024, with the Company having received 329 approvals to date.

The Company now has 49 First-to-File (FTF) filings including 17 exclusive FTF opportunities. Cumulative U.S. DMF filings stand at 157 as of September 30, 2024.

About Lupin

Lupin Limited is a global pharmaceutical leader headquartered in Mumbai, India, with products distributed in over 100 markets. Lupin specializes in pharmaceutical products, including branded and generic formulations, complex generics, biotechnology products, and active pharmaceutical ingredients. Trusted by healthcare professionals and consumers globally, the company enjoys a strong position in India and the U.S. across multiple therapy areas, including respiratory, cardiovascular, anti-diabetic, anti-infective, gastrointestinal, central nervous system, and women’s health. Lupin has 15 state-of-the-art manufacturing sites and 7 research centers globally, along with a dedicated workforce of over 23,000 professionals. Lupin is committed to improving patient health outcomes through its subsidiaries – Lupin Diagnostics, Lupin Digital Health, and Lupin Manufacturing Solutions.

To know more, visit www.lupin.com or follow us on LinkedIn https://www.linkedin.com/company/lupin

For further information or queries please contact –

Rajalakshmi Azariah

Vice President & Global Head – Corporate Communications, Lupin

Email : rajalakshmiazariah@lupin.com