Mumbai, May 18, 2022: Pharma major Lupin Limited [BSE: 500257 | NSE: LUPIN] reported its financial performance for the quarter and fiscal year ending March 31, 2022. These audited results were taken on record by the Board of Directors at a meeting held today. Basis the long-term outlook, the Board has recommended a dividend of 200%.

Financial Highlights – Consolidated IND-AS

Amt in INR mn

| Particulars | Quarter | Full Year | ||||||

| Q4 FY2022 | Q3 FY2022 | YOY Growth % | Q4 FY2021 | YoY Growth % | FY22 | FY21 | YoY Growth % | |

| Sales | 38,645 | 40,875 | ↓ 5.5% | 37,593 | ↑ 2.8% | 161,928 | 149,270 | ↑ 8.5% |

| EBITDA | 2,823 | 4,039* | ↓ 30.1% | 7,657 | ↓ 63.1% | 23,073** | 27,032 | ↓ 14.6% |

| EBITDA Margin (%) | 7.3% | 9.9% | ↓ 260 bps | 20.4% | ↓ 1310 bps | 14.2% | 18.1% | ↓ 390 bps |

| PBT | (852) | 1,671* | ↓ 151.0% | 5,182 | ↓ 116.4% | 12,135*** | 16,751 | ↓ 27.6% |

* Excluding one-time expenses of INR 1932 mn Q3 FY22 EBIDTA was INR 5971 mn and PBT was INR 3603 mn

**EBIDTA before Business Compensation expense

***Adjusted for Solosec Impairment & Business Compensation expense for Glumetza in Q2 FY 22

Income Statement highlights – Q4 FY2022

- Gross Profit was INR 22,323 mn compared to INR 23,929 mn in Q3 FY2022, with margin of 57.8%

- Personnel cost was 18.2% of sales at INR 7,032 mn compared to INR 7,438 mn in Q3 FY2022

- Manufacturing and other expenses were 34.2% of sales at INR 13,212 mn compared to INR 13,518 mn in Q3 FY2022

- Investment in R&D for the quarter was INR 3,442 mn (8.9% of sales)

Balance Sheet highlights

- Operating working capital was INR 60,303 mn as on March 31, 2022

- Capital Expenditure for the quarter was INR 1,577 mn and INR 6,872 mn for FY2022

- Net Debt as on March 31, 2022 stands at INR 19,227 mn

- Net Debt-Equity for the company as on March 31, 2022 stands at 0.16

Commenting on the results, Mr. Nilesh Gupta, Managing Director, Lupin Limited said, “The current quarter was challenging with headwinds in the U.S. on account of price erosion, and inflation in input materials and freight. Our other markets continue solid growth in revenues and profitability. We are focused on optimizing operating expenses and spend and ensuring the evolution of our complex generic platforms along with global portfolio maximization while doubling down on markets like India. We expect our efforts to yield meaningful uptick in profitability, especially in the second half of this fiscal and beyond”

Consolidated Financial Results Q4 FY2022

Amt in INR mn

| Particulars | Q4 FY2022 | % of sales | Q3 FY2022 | % of sales | QoQ Gr% | Q4 FY2021 | % of sales | YoY Gr% |

| Sales | 38,645 | 100.0% | 40,875 | 100.0% | -5.5% | 37,593 | 100.0% | 2.8% |

| Other operating income | 185 | 0.5% | 734 | 1.8% | -74.8% | 238 | 0.6% | -22.3% |

| Total Revenue from operations | 38,830 | 100.5% | 41,609 | 101.8% | -6.7% | 37,831 | 100.6% | 2.6% |

| Material cost | 16,322 | 42.2% | 16,946 | 41.5% | -3.7% | 13,176 | 35.0% | 23.9% |

| Gross Profit (Excl. Other op. income)1 | 22,323 | 57.8% | 23,929 | 58.5% | -6.7% | 24,417 | 65.0% | -8.6% |

| Employee cost | 7,032 | 18.2% | 7,438 | 18.2% | -5.5% | 6,402 | 17.0% | 9.8% |

| Manufacturing & Other expenses1/2 | 13,212 | 34.2% | 13,518 | 33.1% | -2.3% | 11,178 | 29.7% | 18.2% |

| Other Income | 157 | 0.4% | 341 | 0.8% | -54.0% | 486 | 1.3% | -67.7% |

| Forex Loss / (Gain) | (402) | -1.0% | 9 | 0.0% | 4566.7% | (96) | -0.3% | 318.8% |

| EBITDA2 | 2,823 | 7.3% | 4,039 | 9.9% | -30.1% | 7,657 | 20.4% | -63.1% |

| Depreciation, Amortization & Impairment Expense3 | 3,272 | 8.5% | 2,034 | 5.0% | 60.9% | 2,157 | 5.7% | 51.7% |

| EBIT | (449) | -1.2% | 2,005 | 4.9% | -122.4% | 5,500 | 14.6% | -108.2% |

| Finance cost | 415 | 1.1% | 334 | 0.8% | 24.3% | 318 | 0.8% | 30.5% |

| Adjusted Profit Before Tax (PBT) | (864) | -2.2% | 1,671 | 4.1% | -151.7% | 5,182 | 13.8% | -116.7% |

| Business Compensation Expense | (12) | 0.0% | – | – | – | – | ||

| Profit Before Tax (PBT)2 | (852) | -2.2% | 1,671 | 4.1% | 5,182 | 13.8% | ||

| Tax | 4,267 | 11.0% | (3,820) | -9.3% | 540 | 1.4% | ||

| Profit After Tax (PAT) | (5,119) | -13.2% | 5,491 | 13.4% | 4,642 | 12.3% | ||

| (+) Share of Profit from JV | 2 | 0.0% | 0 | 0.0% | 2 | 0.0% | ||

| (-) Non-Controlling Interest | 63 | 0.2% | 36 | 0.1% | 40 | 0.1% | ||

| Profit/(Loss) for the period | (5,180) | -13.4% | 5,455 | 13.3% | 4,604 | 12.2% | ||

- Royalty/Profit Share Expenses on certain in-licensed/partnered products have been reclassified to Material Costs from Manufacturing and Other expenses starting Q1 FY2022. On a comparable basis, the Gross Margin adjusted for such change would be 63.3% of sales in Q4 FY2021. Manufacturing & Other Expenses adjusted for this change related to Royalty/Profit Share Expenses would be 28% of sales in Q4 FY2021.

- In Q3 FY22, other expenses include the impact of one-time expenses of INR 1,932 mn related to residual Metformin returns from retail and consumers not identified previously, and a provision for aged stock returns of Oseltamivir given lack of an active flu season for the past two years.

- Depreciation & Amortization & impairment expense of Q4 FY22 includes INR 1,267 mn on account of impairment of Gavis IPs.

Consolidated Financial Results FY2022

Amt in INR mn

| Particulars | FY2022 | % of sales | FY2021 | % of sales | YoY Gr% |

| Sales | 161,928 | 100.0% | 149,270 | 100.0% | 8.5% |

| Other operating income | 2,127 | 1.3% | 2,360 | 1.6% | -9.9% |

| Total Revenue from operations | 164,055 | 101.3% | 151,630 | 101.6% | 8.2% |

| Material cost | 64,812 | 40.0% | 53,622 | 35.9% | 20.9% |

| Gross Profit (Excl. Other op. income)1 | 97,116 | 60.0% | 95,648 | 64.1% | 1.5% |

| Employee cost | 29,893 | 18.5% | 28,259 | 18.9% | 5.8% |

| Manufacturing & Other expenses1/2 | 48,378 | 29.9% | 43,171 | 28.9% | 12.1% |

| Other Income | 1,417 | 0.9% | 1,363 | 0.9% | 4.0% |

| Forex Loss / (Gain) | (684) | -0.4% | 909 | 0.6% | 175.2% |

| EBITDA2 | 23,073 | 14.2% | 27,032 | 18.1% | -14.6% |

| Depreciation, Amortization & Impairment Expense | 9,510 | 5.9% | 8,874 | 5.9% | 7.2% |

| EBIT | 13,563 | 8.4% | 18,158 | 12.2% | -25.3% |

| Finance cost | 1,428 | 0.9% | 1,407 | 0.9% | 1.5% |

| Adjusted Profit Before Tax (PBT) | 12,135 | 7.5% | 16,751 | 11.2% | -27.6% |

| Business Compensation Expense3 | 18,784 | 11.6% | – | – | |

| Impairment Expense4 | 7,077 | 4.4% | – | – | |

| Profit Before Tax (PBT) 2 | (13,726) | -8.5% | 16,751 | 11.2% | |

| Tax | 1,371 | 0.8% | 4,485 | 3.0% | |

| Profit After Tax (PAT) | (15,097) | -9.3% | 12,266 | 8.2% | |

| (+) Share of Profit from JV | 4 | 0.0% | 13 | 0.0% | |

| (-) Non-Controlling Interest | 187 | 0.1% | 114 | 0.1% | |

| Profit/(Loss) for the period | (15,280) | -9.4% | 12,165 | 8.1% | |

1> Royalty/Profit Share Expenses on certain in-licensed/partnered products have been reclassified to Material Costs from Manufacturing and Other expenses starting Q1 FY2022. On a comparable basis, the Gross Margin adjusted for such change would be 63.1% of sales in FY2021. Manufacturing & Other Expenses adjusted for this change related to Royalty/Profit Share Expenses would be 27.9% of sales in FY2021.

2. In Q3 FY22, other expenses include the impact of one-time expenses of INR 1932 mn related to residual Metformin returns from retail and consumers not identified previously, and a provision for aged stock returns of Oseltamivir given lack of an active flu season for the past two years.

3. In Q2 FY2022 we had created a provision of INR 18,795 mn [including INR 375 mn towards litigation and settlement related expenses] under Glumetza class actions. The amounts due to the two plantiffs group was settled in Q3. We had a small reversal on account of litigation expense in Q4 of INR 12 mn.

4. Q2 FY2022 includes impairment expense of INR 7,077 mn for Solosec® IP.

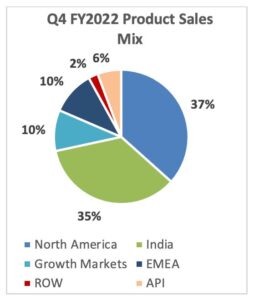

Sales Mix

Amt in INR mn

| Particulars | Q4 FY22 | Q3 FY22 | Growth QoQ | Q4 FY21 | Growth YoY |

| North America | 14,162 | 15,775 | -10.2% | 14,952 | -5.3% |

| India | 13,511 | 14,733 | -8.3% | 12,866 | 5.0% |

| Growth Markets | 3,810 | 3,390 | 12.4% | 3,033 | 25.6% |

| EMEA | 4,072 | 3,422 | 19.0% | 3,749 | 8.6% |

| ROW | 887 | 991 | -10.5% | 437 | 103.0% |

| Total Formulations | 36,442 | 38,311 | -4.9% | 35,037 | 4.0% |

| API | 2,203 | 2,564 | -14.1% | 2,556 | -13.8% |

| Consolidated Sales | 38,645 | 40,875 | -5.5% | 37,593 | 2.8% |

Amt in INR mn

| Particulars | FY22 | FY21 | Growth YoY |

| North America | 57,556 | 55,520 | 3.7% |

| India | 60,042 | 52,712 | 13.9% |

| Growth Markets | 14,019 | 11,964 | 17.2% |

| EMEA | 13,592 | 12,781 | 6.3% |

| ROW | 3,081 | 2,470 | 24.7% |

| Total Formulations | 148,290 | 135,447 | 9.5% |

| API | 9,904 | 13,823 | -28.4% |

| Total Product Sales | 158,194 | 149,270 | 6.0% |

| NCE Licensing Income | 3,734 | – | NA |

| Consolidated Sales | 161,928 | 149,270 | 8.5% |

Operational Highlights

North America

North America sales for FY2022 were INR 57,556 mn compared to INR 55,520 mn in FY 2021; accounting for 36% of Lupin’s global sales. Q4 FY2022 sales were INR 14,162 mn, down 10.2% compared to INR 15,775 mn in Q3 FY2022, down 5.3% as compared to INR 14,952 mn in Q4 FY2021; accounting for 37% of Lupin’s global sales.

U.S. FY2022 sales were USD 738 mn compared to USD 720 mn in FY2021.

Q4 FY2022 sales were USD 181 mn compared to USD 202 mn in Q3 FY2022 and USD 195 mn in Q4 FY2021.

The Company filed 10 ANDAs in the quarter, received 2 ANDA approvals from the U.S. FDA, and launched 2 products in the quarter in the U.S. The Company now has 166 generic products in the U.S.

Lupin continues to be the 3rd largest pharmaceutical player in both U.S. generic market and U.S. total market by prescriptions (IQVIA MAT March 2022). Lupin is the leader in 44 of its marketed generics in the U.S. and amongst the Top 3 in 113 of its marketed products (IQVIA MAT March 2022).

India

India formulation sales for FY2022 were INR 60,042 mn, up 13.9% as compared to INR 52,712 mn in FY2021; accounting for 38% of Lupin’s global sales. Q4 FY2022 sales were INR 13,511 mn, down 8.3% as compared to INR 14,733 mn in Q3 FY2022, up 5.0% as compared to INR 12,866 mn in Q4 FY2021; accounting for 35% of Lupin’s global sales.

India Region Formulations sales grew by 13.3% in the quarter as compared to Q4 FY2021. The company launched 1 brand in the Anti-Diabetic therapy, 1 brand in the Anti-Viral therapy and 1 brand in the VMS therapy in the quarter.

Lupin is the 6th largest company in the Indian Pharmaceutical Market (IQVIA MAT March 2022).

Growth Markets (LATAM and APAC)

Growth Markets sales for FY2022 were INR 14,019 mn, up 17.2% as compared to INR 11,964 mn in FY2021; accounting for 9% of Lupin’s global sales. Q4 FY2022 sales were INR 3,810 mn, up 12.4% compared to INR 3,390 mn in Q3 FY2022, up 25.6% as compared to INR 3,033 mn in Q4 FY2021; accounting for 10% of Lupin’s global sales.

Brazil sales were BRL 224 mn for FY2022, compared to a sales of BRL 239 mn for FY2021. Q4 FY2022 sales were BRL 64 mn, compared to BRL 49 mn for Q3 FY2022 and BRL 59 mn for Q4 FY2021.

Mexico sales were MXN 713 mn for FY2022, compared to a sales of MXN 621 mn for FY2021. Q4 FY2022 sales were MXN 183 mn, compared to MXN 195 mn for Q3 FY2022 and MXN 154 mn for Q4 FY2021.

Philippines sales were PHP 1,881 mn for FY2022, compared to a sales of PHP 1,388 mn for FY2021. Q4 FY2022 sales were PHP 475 mn, compared to PHP 401 mn for Q3 FY2022 and PHP 402 mn for Q4 FY2021.

Australia sales were AUD 74 mn for FY2022, compared to a sales of AUD 57 mn for FY2021. Q4 FY2022 sales were AUD 20.8 mn, compared to AUD 17.8 mn for Q3 FY2022 and AUD 14.2 mn for Q4 FY2021.

Europe, Middle-East and Africa (EMEA)

EMEA sales for FY2022 were INR 13,592 mn, up 6.3% as compared to INR 12,781 mn in FY 2021; accounting for 9% of Lupin’s global sales. Q4 FY2022 sales were INR 4,072 mn, up 19.0% compared to INR 3,422 mn in Q3 FY2022, up 8.6% compared to INR 3,749 mn in Q4 FY2021; accounting for 10% of Lupin’s global sales.

South Africa sales were ZAR 1,375 mn for FY2022, compared to a sales of ZAR 1,295 mn for FY2021. Q4 FY2022 sales were ZAR 426 mn, compared to ZAR 319 mn in Q3 FY2022 and ZAR 431 mn in Q4 FY2021. Lupin is the 6th largest player in South Africa in the total generics market (IQVIA February 2022).

Germany sales were EUR 32.4 mn for FY2022, compared to a sales of EUR 29.2 mn for FY2021. Q4 FY2022 sales were EUR 8.4 mn, compared to EUR 8.8 mn in Q3 FY2022 and EUR 5.4 mn in Q4 FY2021.

Global API

Global API sales for FY2022 were INR 9,904 mn, down 28.4% as compared to INR 13,823 mn in FY2021; accounting for 6% of Lupin’s global sales. Q4 FY2022 sales were INR 2,203 mn, down 14.1% as compared to INR 2,564 mn in Q3 FY2022, down 13.8% as compared to INR 2,556 mn in Q4 FY2021; accounting for 6% of Lupin’s global sales.

Research and Development

Investment in R&D was INR 14,024 mn (8.7% of sales) for FY2022 and INR 3,442 mn (8.9% of sales) in Q4 FY2022.

Lupin received approval for 2 ANDAs from the U.S. FDA in the quarter. Cumulative ANDA filings with the U.S. FDA stand at 457 as of March 31, 2022, with the company having received 297 approvals to date.

The Company now has 53 First-to-File (FTF) filings including 21 exclusive FTF opportunities. Cumulative U.S. DMF filings stand at 196 as of March 31, 2022.

About Lupin

Lupin is an innovation-led transnational pharmaceutical company headquartered in Mumbai, India. The Company develops and commercializes a wide range of branded and generic formulations, biotechnology products, and APIs in over 100 markets in the U.S., India, South Africa, and across the Asia Pacific (APAC), Latin America (LATAM), Europe, and Middle East regions.

The Company enjoys a leadership position in the cardiovascular, anti-diabetic, and respiratory segments and has a significant presence in the anti-infective, gastro-intestinal (GI), central nervous system (CNS), and women’s health areas. Lupin is the third-largest pharmaceutical company in the U.S. by prescriptions. The company invested 8.7% of its revenue in research and development in FY22.

Lupin has 15 manufacturing sites, 7 research centers, more than 20,000 professionals working globally, and has been consistently recognized as a ‘Great Place to Work’ in the Biotechnology & Pharmaceuticals sector.

Please visit www.lupin.com for more information.

Follow us on Twitter: https://twitter.com/LupinGlobal

LinkedIn : https://www.linkedin.com/company/lupin

Facebook: http://www.facebook.com/LupinWorld/

For further information or queries please contact –

Shweta Munjal

Vice President & Global Head – Corporate Communications

Email: shwetamunjal@lupin.com